Whether you’re relaxing on the beach, sipping coffee in the office or having some Summer adventures, we’ve got some updates and insights to share.

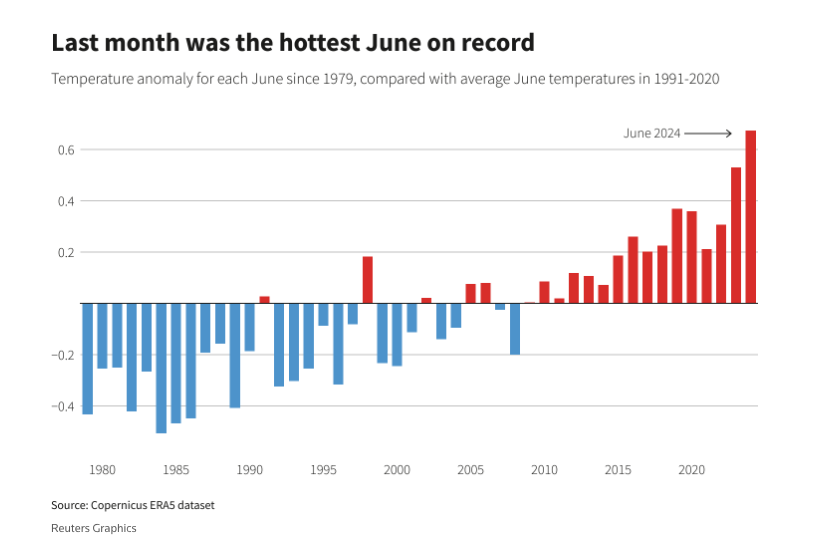

Recent reports reveal alarming climate trends, including hottest June of all time. These changes underscore also the urgent need for sustainable investing and that’s why we have some sustainability trends in the spotlight this time!

Take a minute to catch up on the latest trends in sustainable investing, general market movements and, of course, how your portfolios are performing!

Enjoy!

Trends in sustainable investing

Europe leads sustainable investing.

According to the Morningstar database, European sustainable funds registered almost USD 11 billion of inflows last quarter. Europe remains the leading region in sustainability and by far the world’s largest market for sustainable funds, having 84% of market share of total assets under management globally.

Happy anniversary, ESG investing!

Fun fact: ESG (Environment, Social, Governance)investing celebrates its 20-year anniversary this year. It evolved from an early approach called “socially responsible investing.

Future of sustainable investing according to Morningstar experts. 4

🌱New Regulations and Standards:

Get ready for ESG metrics like greenhouse gas emissions and workforce data to become as standard as financial statements. Just like we have accounting principles today, global regulations for climate risk management disclosures are on the way.

🌱Impact Investing in a rise:

New EU regulations will soon require companies to report on both business risks and their environmental and social impact. This means impact investing will continue to gain momentum.

🌱Fossil fuel investing is on its way out.

In the next five years, sustainable funds are expected to significantly reduce their fossil fuel investments, moving towards a cleaner future. There is no more time to wait!

🌱AI in sustainability:

Artificial intelligence will change how we gather and analyze sustainability data, making it easier to manage those vast amounts of information that is out there.

Grünfin portfolios continue to perform well

Sustainability is outperforming.

Our long-term customers, who have invested regularly, can take delight in seeing their portfolios in green. Our best performing themes have been S&P500 Planet Friendly (+20.12%) and Climate (+8.88%) both outperforming their peer indices' S&P 500 (+15.29%) and MSCI EAFE PR (+3.51%) year-to-date in the first half of 2024.

Since our founding, our philosophy has been to invest long-term, regularly and in diversified sectors, and refrain from timing the market. Combined with our focus on strong, Paris-aligned companies, it has proven itself well.

Our customers continue to increase their investments

Flows to our portfolios continued due to good market sentiments and confidence in the market. Many of our customers have increased their one time payments this quarter, showing trust in our expertise of securing wealth growth.

Grünfin’s Sustainability: Proven and Certified

Since March 2024, Grünfin is proud to be a B-Corp!

The B Corp certification, also known as the “gold standard for sustainability” is the world’s most recognized sustainability credential, evaluating companies’ social and environmental impact.

In simple words, it’s third-party confirmation that our “green” label stands for genuine action and transparency.

As Green as Patagonia

Our impact score is 156.1 out of 200, placing us in the same sustainability category as Patagonia (166/200). For context, the average company scores around 50, while B-Corp certification requires at least 80, the maximum score so far is 184.1. That makes us really proud!

Actions with ShareAction

As a part of the ShareAction coalition, we want to see big corporations play their part in tackling the climate crisis, improving working conditions, protecting nature and doing their best to create healthier societies.

See the achievements of the 1st half of the year

Chats with Clients: Your Favorite Feature is…

We had some insightful discussions with our clients in May and June. Thank you to everyone who joined our client interviews. You shared, we listened. Feel free to reach out with feedback whenever!

What You Love Most

The top feature you love? Grünfin helps you create a personalized portfolio and manages it throughout the investment period with better contribution to the planet and its people.

Did You Know?

35% of our customers heard about Grünfin from a friend, who described us to them as “an easy way to have experts take care of growing wealth.” Not everyone loves to follow economic news and the stock market non-stop—and that’s exactly who Grünfin is perfect for.

Highlight of the Quarter: CEO Karin Meets U.S. Treasury Secretary Yellen

Our co-founder Karin was invited to join a delegation of 10 coolest green tech and sustainable finance startups for a 1-hour discussion with Janet Yellen, the US Secretary of the Treasury.

During her conversations with her, Karin raised our concerns on the U.S largest asset managers sustainability related voting practices on corporate boards and need for higher disclosure and action. In addition, our interest is to collaborate with sustainability minded asset managers and help them to scale their offering to the EU.

These could also be interesting to you

Quaterly news from Grünfin 2024 Q3

Quarterly (q3, 2024) updates about the financial markets, news, and your portfolio performance.

Quaterly news from Grünfin 2024 Q2

Quarterly updates about the financial markets, news, and your portfolio performance.

Quaterly news from Grünfin 2024 Q1

Grünfin quaterly news about financial markets and Grünfin sustainable portfolios.