The hottest summer in history (again!) is officially over.

Whether you check your calendar or look outside, life feels like it’s picking up pace. Work meetings are becoming more productive, schools are in full swing, and the news is shifting to more serious topics like elections, (un)employment, and economics, leaving the slower summer season behind.

So please take some minutes to go through some good news, including insights into your Grünfin portfolios, the impact you’re making, and highlights of how Grünfin is doing overall.

Sustainability keeps showing great results. Financially and impactfully.

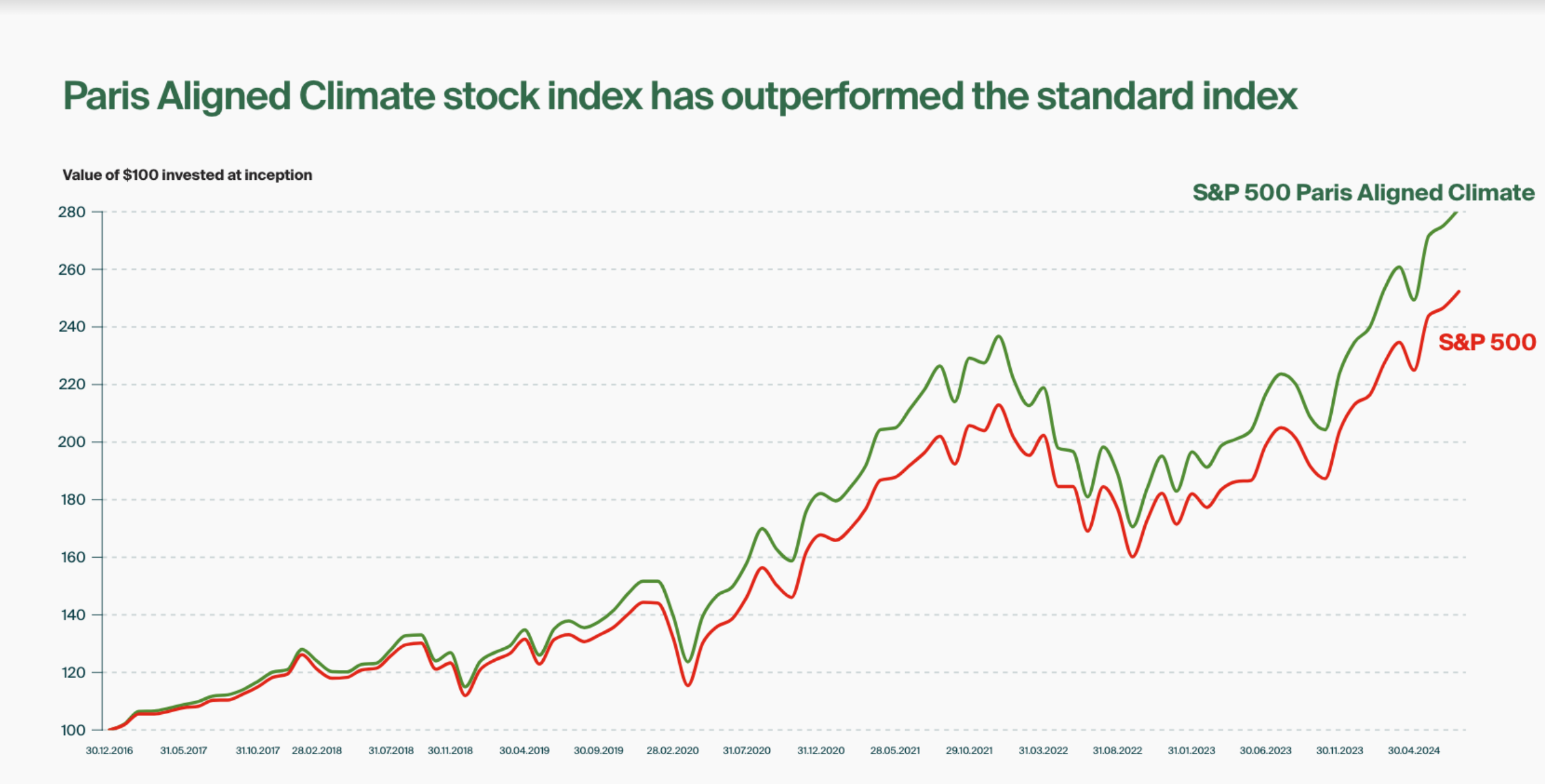

Grünfin portfolios continue to perform well. Our best performing themes have been S&P500 Planet Friendly (+20.12%) and Climate (+8.88%) both outperforming their peer indices' S&P 500 (+15.29%) and MSCI EAFE PR (+3.51%) year-to-date in the first half of 2024.

Highlight of the Quarter: Grünfin reviewed by Capital magazine—ranked #2 based on portfolio returns*!

(out of 39 investment solution providers)

Capital, a leading economic magazine in Germany, recently reviewed 39 robo-advisors available on the market. Grünfin, launched in Germany in March 2022, earned an impressive 4 out of 5 stars, placing us solidly in the middle of the rankings, ahead of many well-known robo-advisors like Scalable Capital or Raisin Invest.

But the real standout? Our returns! When it came to portfolio performance alone, Grünfin tied for 2nd and 3rd place based on returns. It proves that impact investing can be both, rewarding and financially strong.

So sustainability and strong returns don’t have to be a trade-off—you can really have both!

*Past performance is never a guarantee of a future performance.

Path to Net Zero: The real impact of your portfolios—let’s take a look!

Summer 2024 was the hottest on record, beating the previous record set in 2023 by 0.1 degrees Celsius. August alone shattered heat records, highlighting the urgency of addressing climate change.

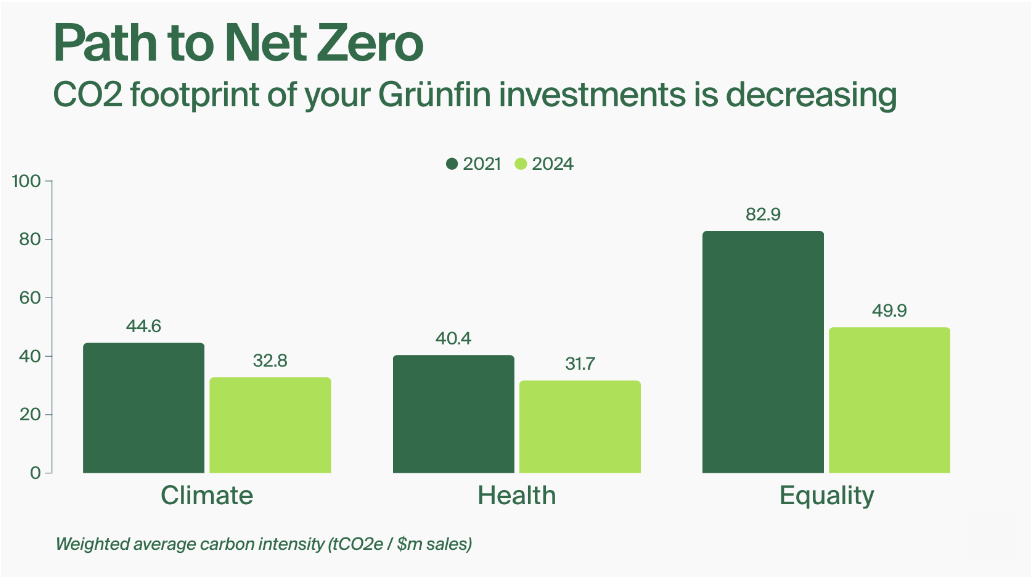

While CO2 emissions play a major role in this warming trend, there’s good news: your Grünfin portfolio is part of the solution.

For instance, our Climate portfolio now has a 26.4% lower CO2 footprint compared to 2021, with emissions dropping from 44.6 tCO2e/$m sales to 32.8 tCO2e/$m sales.

Source: MSCI ESG Fund Ratings. Indices used: Grünfin portfolio compositions with Climate, Health and Equality themes and Progressive risk level. Data obtained from 02/12/21-09/12/21 and 05/09/24

Why are CO2 emissions dropping—and continuing to drop?

The companies in our Climate portfolio are committed to reducing their CO2 emissions by at least 7% annually, in line with the Paris Agreement. And they’re delivering on that promise!

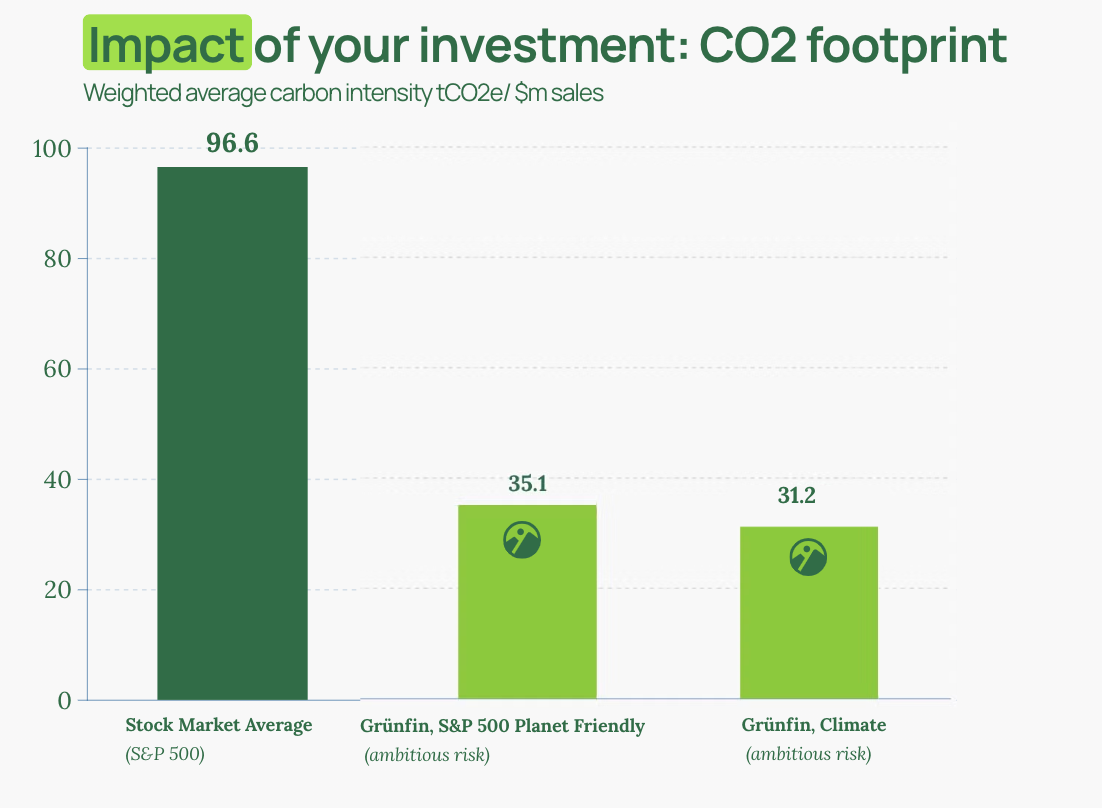

As a result, the carbon footprint of Climate Progressive portfolio is now 66.1% lower than the S&P 500, making it 2.9 times cleaner.

Our Climate Ambitious portfolio goes even further, with an impressive 3.1 times lower CO2 footprint than the S&P 500. It is a huge difference here!

Diversity is making progress, too.

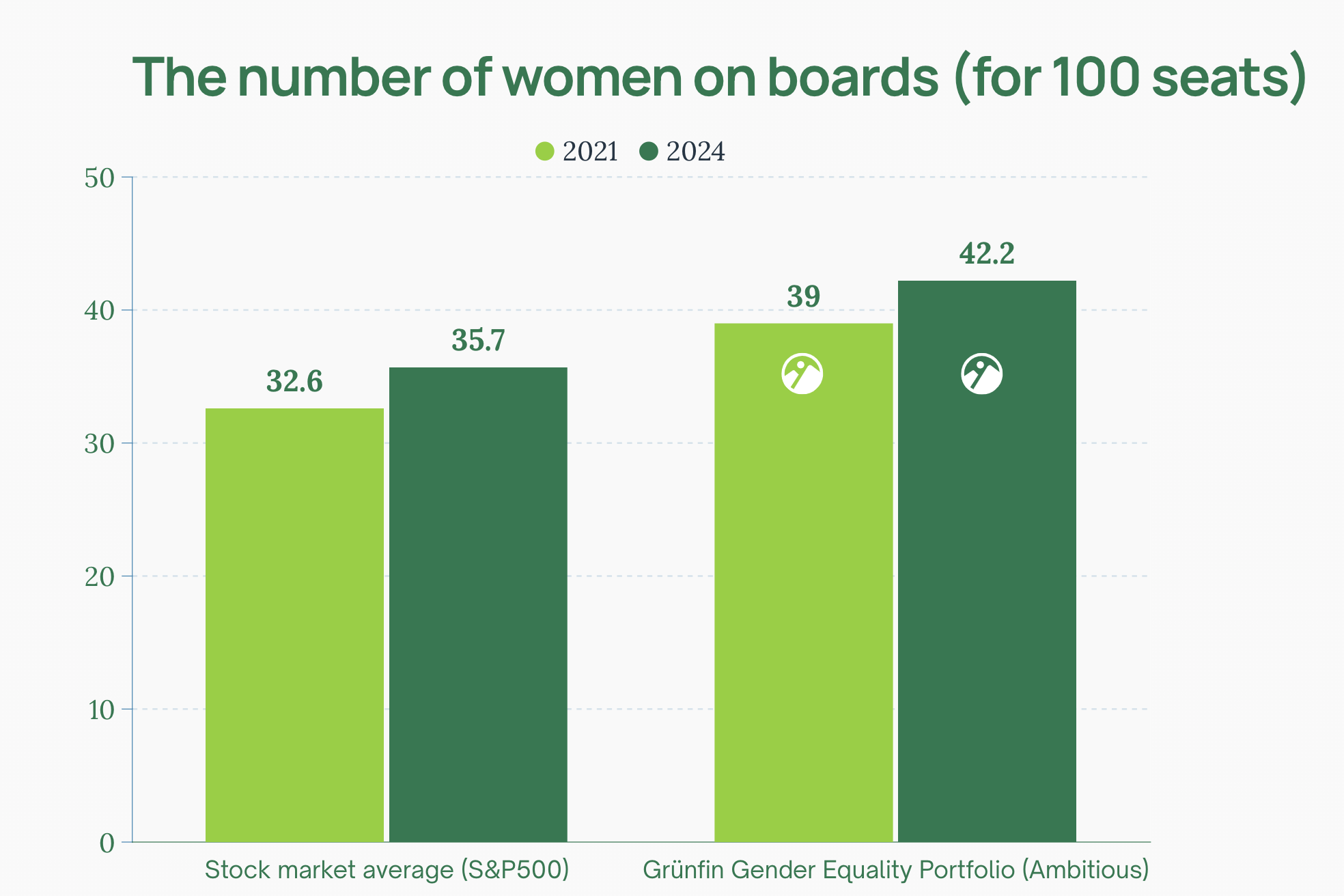

Our Gender Equality portfolio* continues to lead the way. In 2024, women hold 42.2% of board seats in companies within this portfolio, compared to 35.7% in the S&P 500. Back in 2021, those figures were 39.0% and 32.6%, respectively.

The upward trend is clear with the faster progress toward gender diversity comparing the broader market.

*we acknowledge the portfolios are different based on the themes and the proportion of the stocks and bonds inside it. We use data based on Ambitious risk level.

Together with ShareAction: On a mission to change companies

“If big companies change, even small steps can make a huge impact,” and that’s why we love working with ShareAction. Together, we’re pushing corporations to up their sustainability game.

See the latest achievements

Grünfin in TOP5 sustainability developer

EAS (Enterprise Estonia) has chosen Grünfin as one of the TOP5 sustainability developers in Estonia.

It’s beautiful to see the growing awareness of finance’s role in sustainability and getting noted in this new-minded area of sustainability. We feel like real winners here already!

These could also be interesting to you

Quaterly news from Grünfin 2024 Q3

Quarterly (q3, 2024) updates about the financial markets, news, and your portfolio performance.

Quaterly news from Grünfin 2024 Q2

Quarterly updates about the financial markets, news, and your portfolio performance.

Quaterly news from Grünfin 2024 Q1

Grünfin quaterly news about financial markets and Grünfin sustainable portfolios.