Being unaware of how we invest – ignoring impact – is one of the key reasons the world is on an unsustainable track.

Money has the power to redesign the world, and investors have the strength to influence corporate action. It’s time to change how we invest and become conscious, values-based investors.

ESG - 3 dimensions of sustainable investing

Sustainable investing adds to your traditional investment a new dimension.

Traditional investing is two-dimensional. It’s looking for the best opportunities in terms of risk and return while ignoring the impact on people and the planet.

Sustainable investing adds a much-needed third dimension – the more significant impact on people and the planet.

The investment world calls this dimension ESG - environmental, social, and governance.

Considering ESG in your investment strategy is not a tree-hugging version of investing that sacrifices gains for the greater good.

On the contrary, the three-dimensional view of investing also makes a lot of financial sense.

How sustainable investment makes financial sense?

First of all, the economy is already changing due to carbon-reduction policies. While changes always offer a lot of opportunities, the companies at the same time also face risks related to the shift to a low-carbon economy. Especially it affects concrete, steel, aviation, automobiles, utilities, and fossil-fuel industries.

Some sectors of the economy could face significant shifts in:

- asset values,

- higher costs of doing business,

- outplacement of technology,

- or a drop in customer demand.

It could be the result of people preferring more sustainable solutions. Unsustainable practices also pose a risk to a company’s reputation.

Sustainable investing has the potential to manage uncertainties related to changes and monetize opportunities.

Sustainable investment helps to implement already existing technologies that help to combat climate change, protect biodiversity or improve waste management.

As well, sustainable investing allows you to support the causes you believe in and earn market-based financial returns.

Grünfin’s 7 principles of sustainable investing

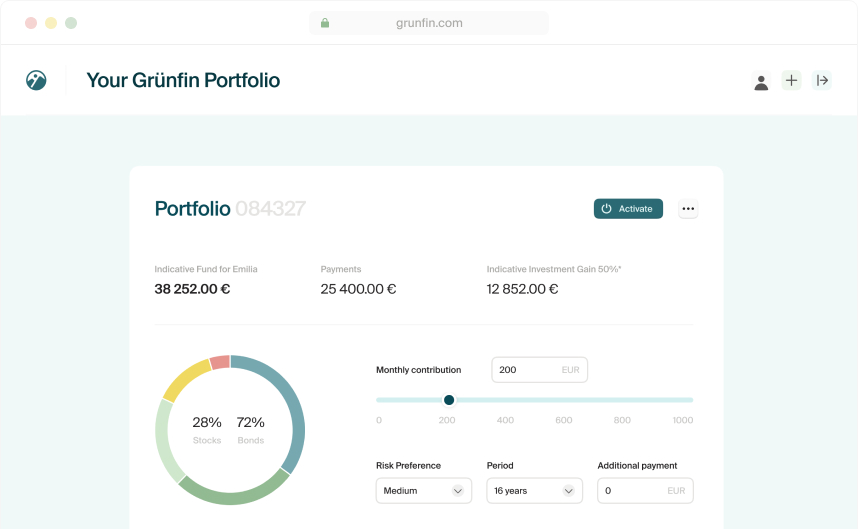

Our clients’ portfolio instruments are limited to sustainable exchange-traded and index funds that are traded on European stock exchanges.

We only provide sustainable investment funds that comply with the Sustainable Finance Disclosure Regulation (SFDR Article 8 and Article 9).

Our impact focus means that we prefer Article 9 over Article 8 funds, given that Article 9 sets sustainability as an explicit objective. In Grünfin, we focus on climate change, equality, and health.

We have a transparent, sustainable investment strategy. For assessing and rating the sustainable funds, we have the following criteria and points of consideration :

- Sustainable Finance Disclosure Regulation SFDR Article 8 (promotes sustainability and considers ESG risks) and Article 9 (sets impact as objective);

- Preferably MorningStar Sustainability Rating 4 or 5;

- Preferably MSCI Sustainability Rating A or higher;

- tons/MUSD CO2

- Green vs. brown revenue;

- % of women on board;

- % board independence;

- Peer and global rank;

- Specific adherence to the UN Global Compact Principle 2, which requires businesses to make sure they are not complicit in human rights abuses;

- Lack of severe controversies;

- The specific exclusion of weapons and tobacco companies;

- Low-cost, passively managed ETFs or index funds;

- Fund’s liquidity;

- Currency: EUR.

- We have explained these criterias in our article about SFDR.

We are independent in providing our service. We screen thousands of funds offered in EUR denomination on the European market service provider neutrally. It means we are not giving preference to any specific asset manager.

We stand for client interest. We do not receive incentives from asset managers nor hide fees in the product.

Our pricing aligns with our clients' goals – we charge a minimum monthly fee and a success fee only when we exceed our set performance target.

We help our clients build a values-based portfolio. We tailor our clients’ portfolios based on their preference for a specific sustainability theme (climate change, equality and health), time horizon, risk preference, and goals. We ask for these preferences for each portfolio.

We believe in a low-cost, diversified, and long-term investment strategy.

We exclusively select sustainable funds of asset managers that are signatories of the UN Principles for Responsible Investment and Climate Action +100. We evaluate if they engage properly in shareholder engagement and vote for the sustainability resolutions.

Let’s dive deeper into some of these principles.

How do we find the best sustainable funds?

There are already more than 3000 sustainable funds around the world. It made no sense for Grünfin to start another one at this stage.

Instead, we’ve chosen to build our client portfolios from the world’s best sustainable Exchange-Traded Funds (ETFs).

We view investments in the major market indices through the lens of Environmental Social and Governance (ESG) and the UN Sustainable Development Goals (SDG).

In Grünfin, we specifically focus on three dimensions:

- Climate Change,

- Equality,

- and Health.

As part of our investment processes, we screen the best sustainable funds by the world’s top asset managers, with no preference for service providers.

Unlike banks, who are often interested in selling their instruments, we have committed to being service provider neutral.

We believe in a long-term, low-cost, well-diversified, and values-based investment strategy.

Not all ESG funds are equally green

The focus of ESG funds on sustainability and impact varies a lot.

So you need to look beyond the label and get to know different sustainable investing strategies. Knowing the especially important when going beyond minimising risk aims and moving to values-based, more impactful investing.

Investor intentions and fund philosophy matter.

In Grünfin, our climate change portfolio complies with EU Sustainable Finance Disclosure Regulation, Article 9 (“dark green”).

These funds have specifically set sustainable goals as their objectives. For example, investing in companies whose goal is to reduce CO2 carbon emissions.

Equality and health with the highest sustainable standards

Grünfin’s “Equality” and “Health” portfolio complies with EU Sustainable Finance Disclosure Regulation an Article 8 (“light green”). Article 8 funds promote E, S, and G characteristics but don’t set them as the overarching objective.

Article 9 sets high standards for the funds. At this time, we could not introduce Article 9 funds in our Equality and Health portfolios. Currently, none of the passively-managed ETF and index funds in these themes would comply.

We will be keeping our eyes open for new Article 9 funds in Equality and Health themes. The hope is to introduce them to our portfolios as soon as possible.

Keeping an eye on EFT investor words and actions

We also analyze the investor´s behavior in active ownership or stewardship. Some values we see:

- Do they have appropriate shareholder engagement programs?

- Do they report to their investors on the impact of their engagement efforts?

- Do they report on the societal impact of the companies they own?

- Or on the projects, they help finance through their fixed-income investments?

Active asset owners can encourage businesses to develop socially responsible practices by taking an active role in their ownership.

The investor or fund encourages the companies to improve their ESG risk management with active ownership. The action helps develop more sustainable business practices like setting targets to decrease their carbon footprint.

These sustainable decisions can happen both through direct engagement and proxy voting.

Does Grünfin provide impact investing?

Impact investing, and sustainable investing have a lot in common. They both aim to bring about a better world.

However, sustainable investing is liquid – it’s possible to buy and sell anytime.

Impact investing is illiquid. Impact investors invest in private companies, may compromise on financial goals and have larger management fees.

This means sustainable investing is always impact investing, but impact investing does not necessarily be sustainable investing.

At Grünfin, we assume that financial goals and liquidity are as important for our customers as impact goals.

We believe that if the asset owner sits on a large polluter’s board and engages in sustainability topics, the results have more weight than financing small community impact projects.

This means direct influence over setting targets to lowering their carbon footprint by 7% each year or coming up with new, clean technology.

Of course, impact investors may be able to measure impact more tangibly. On the other hand, it does less to change the big picture.

Focusing on 20% usually gives 80% of the results.

Investing in the long term and low cost

We made an important decision in Grünfin along the way to focus on long-term, low-cost, and diversified investing. Why?

New tools have made investing and trading stocks incredibly easy. Investing in products that offer commission-free trading has increased access to financial markets.

At the same time, these products have encouraged people to take on risks similar to gambling. Outsmarting the market is usually a bad long-term strategy. One study found that only 5 percent of active retail traders made any profit over twelve years at all.

We consciously encourage people to hold onto their investments over a long period.

The longer timeframe helps the dynamics of financial markets deliver performance to achieve set targets.

How do we deal with changes in the financial market?

Investing is all about focusing on your financial goals and ignoring the noisy nature of the markets and the media that covers them.

Once you have established your portfolio, we recommend buying and holding the investment for the long haul. Also, it’s best to keep on investing according to planned investment contributions.

Do not let yourself be influenced by short-term market movements and stay focused on the long-term portfolio saving goals.

Usually, when there is a sudden market downturn, there’s a lot of fear and anxiety. You might see your investment portfolio value go down. But selling at that time and locking in losses is the worst thing you can do.

Often it’s a good time for portfolio managers to rebalance your portfolio, and buy more relatively lower-priced asset classes. This way, you’ll be taking advantage of the market turning upward again.

We commit to ensure that our customer portfolios are rebalanced annually to keep target asset allocations and take advantage of market movements. We have also revealed our 5 secrets how sustainable portfolio can outperform many markets.

Our investment principles in Grünfin.

Sustainable, long-term, low-cost, and the real impact. All based on your values.

Here’s a summary of Grünfin’s sustainable investing principles:

- We don’t just consider risk and return but also the larger impact on people and the planet.

- We screen, analyze and rate the best sustainable funds worldwide to build our client portfolios without preferring any single service provider.

- We prioritize impact, investor intentions, and fund philosophy and tailor portfolio based on your values.

- We rebalance not just to maintain risk levels but also to increase the portfolio returns on market movements.

- We encourage focusing on long-term investing (low cost, diversification) and portfolio results.

- When your portfolio performance exceeds the targets and does well, the success is shared between the customer and Grünfin.

-

Read more about Grünfin’s sustainability principles.

Start your sustainable investment with Grünfin. We help you invest your money where your values are.

These could also be interesting to you

Quaterly news from Grünfin 2024 Q3

Quarterly (q3, 2024) updates about the financial markets, news, and your portfolio performance.

Quaterly news from Grünfin 2024 Q2

Quarterly updates about the financial markets, news, and your portfolio performance.

Quaterly news from Grünfin 2024 Q1

Grünfin quaterly news about financial markets and Grünfin sustainable portfolios.