Why invest with Grünfin?

Your investments have a positive impact. You'll put your money to work for a sustainable future. We'll make sure it leaves a mark.

You value your time. We invest your company's funds for you. Your money earns market-based returns and you can concentrate on your business - or hobbies!

Best investment strategy. We invest for the long term, into ETFs with low fees. You win time and peace of mind.

Sustainability is a trend. Sustainable funds have grown 4× over the past 5 years and weathered the recent crisis better than traditional funds.

The impact of your investments

Companies in your portfolio

Pricing

Per year 0,7 % of holdings

What's included

all sales and purchases

portfolio management, administration

cost of guarantee fund

In addition

No hidden fees!

Frequently Asked Questions

Can I use Grünfin to invest for my legal entity (OÜ)?

Can I use Grünfin to invest for my legal entity (OÜ)?

Yes, you can open a Grünfin portfolio to invest your company's assets if

You are a resident of the European Economic Area

Your company is registered in Estonia

Your company's shareholder, management and beneficiary structure is clear and simple

Can I choose the stocks and ETFs to my OÜ portfolio?

Can I choose the stocks and ETFs to my OÜ portfolio?

No, you can't. The stock market is huge and making well-considered investment choices requires an enormous amount of your time.

🌱 Our aim is to make investing as easy and convenient as possible, so you can spend your time on what really matters and focus on your OÜ's activities.

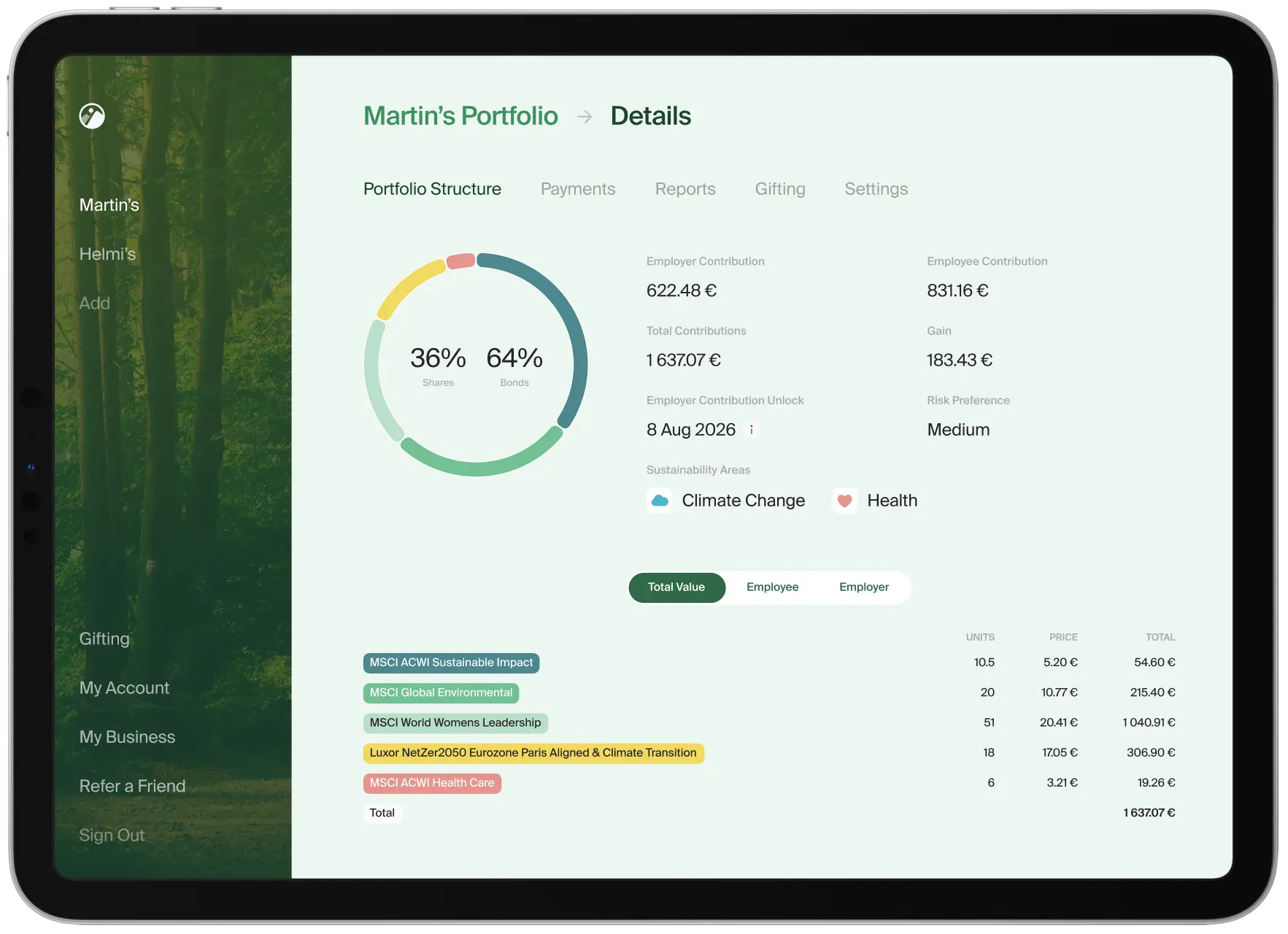

🌱 You can choose the themes that are closest to your heart - climate, equal opportunities, S&P 500 Planet Friendly and/or health. We'll find the best ETFs that match your preferences.

We'll make sure your assets grow and your choice of ETF's follows the market. As new and better funds become available, we'll pick them for you.

What returns can I expect from sustainable investments?

What returns can I expect from sustainable investments?

One of the main concerns for investors is if they’re sacrificing profit for sustainability. The answer is no. The performance of sustainable investment funds is similar conventional funds.

🌱 For example, looking at S&P500 as the benchmark, we can see that the average annual return from 1957 through 2021 is roughly 8%.

🌱 Sustainable investing is a way of future-investing and in a number of reports, sustainable funds also show better historical performance.Moreover, we strongly believe that sustainable companies are well-positioned for long-term success due to lower risks, increasing customer demand, and innovative solutions.

Are my investments in Grünfin diversified?

Are my investments in Grünfin diversified?

The exchange traded funds (ETF) and index-funds are diversified a great deal consisting of hundreds of different assets and have therefore lesser concentration risk involved. Your investments are well distributed geographically and across industries.

The allocation of stocks and bonds in your Grünfin portfolio is in accordance with your preferred risk level.

How does the pricing work for OÜ portfolios?

How does the pricing work for OÜ portfolios?

Your company's Grünfin portfolio has a yearly fee of 0,7%, charged monthly from your portfolio.

The 0,7% fee covers:

🌱 building and managing your OÜ portfolio

🌱 all transaction fees to buy and sell

🌱 keeping your funds safely in the bank

🌱 regular screening for the best sustainable ETFs across all service providers

🌱 rebalancing your portfolio - not just to maintain risk levels but also to increase the portfolio returns on market movements

🌱 engaging with top leaders of the biggest companies in our portfolios to push them to more positive change.

No hidden fees!